▶Meets U.S. federal travel insurance requirements for J1 and J2 visas.

▶ Applicable to J1 and J2 visa holdersof those who study abroad or participate in cultural exchange programs Individuals and groups of two or more students.

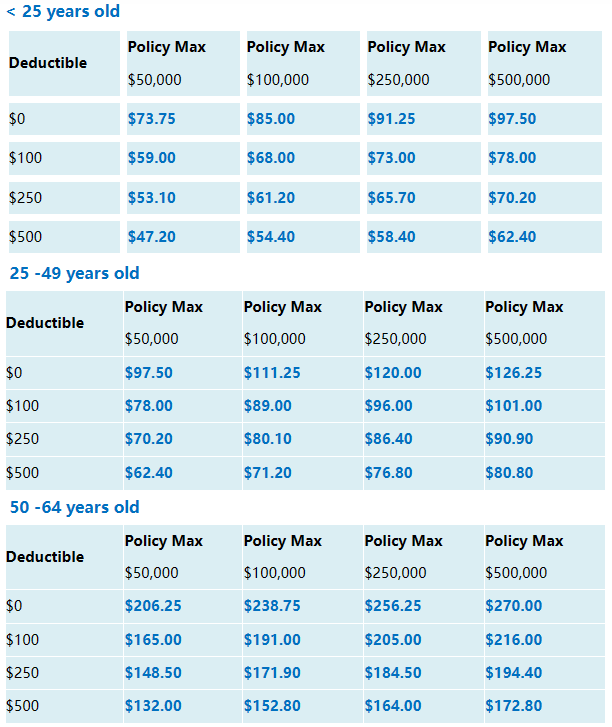

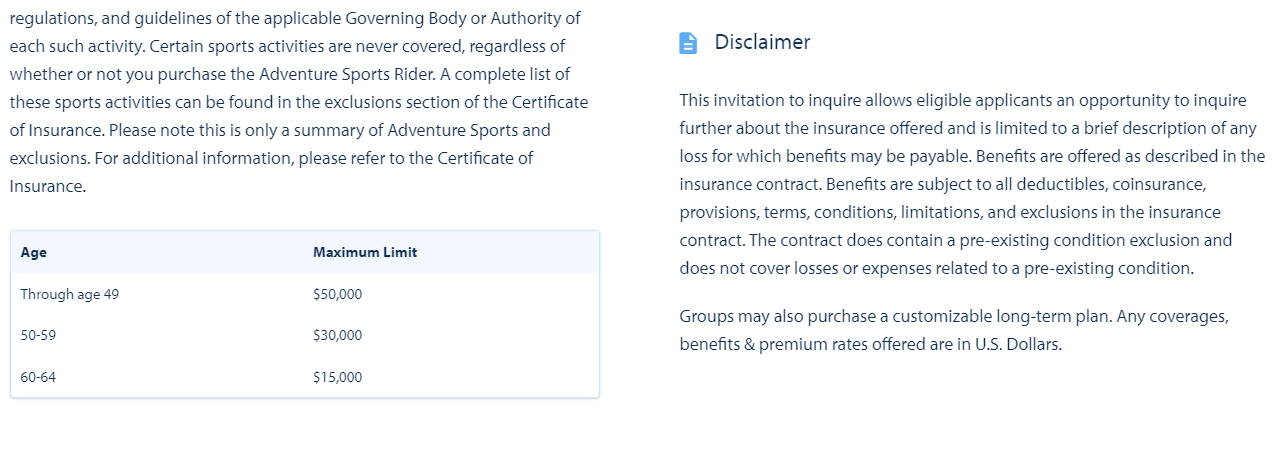

▶ Maximum medical insurance options for J1/J2 visas are $50,000, $100,000, $250,000, and $500,000 for each illness/accident.

▶ For J1/J2 visas, $50,000 is not an option for the maximum medical coverage amount for each illness/accident.

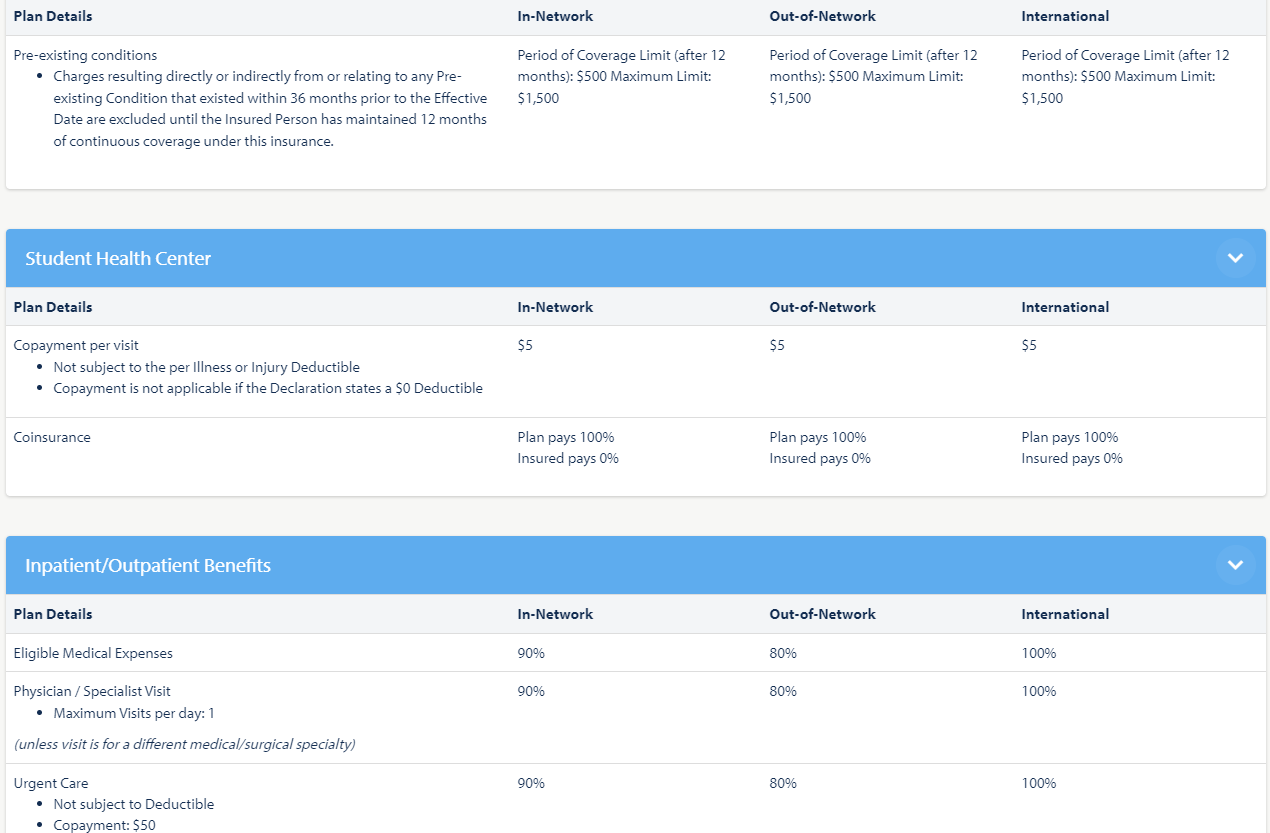

▶ $5 copay per visit to Student Health Center.

▶ The maximum medical coverage limit is $5,000,000.

▶ Deductible options range from $0 to $500.

▶ 24/7 non-urgent care within the United States.

▶ COVID-19 coverage is the same as any other illness.

▶ PrecertificationI :

Interfacility Ambulance Transfer, Emergency Medical Evacution:

No coverage if Pre-certification requirements are not met

All o ther Treatments & supplies:

50% reduction of Eligible Medical Expenses if Pre-certification requirements are not met

▶Period of Coverage: 1 month up to 12 months - renewable up to 48 months

▶Coinsurance: In addition to Deductible,

in-network: plan pays 90%, insured pays 10%;

out -of-network:plan pays 80%; insured pays 20%;

international: plan pays 100%, insured pays 0%.

1. Coverage and benefits are subject to deductibles, limits and coinsurance and all terms of the certificate of insurance and master policy

2. Medical expenses must comply with hospital regulations

3. The medical expenses incurred must be during the insurance period or welfare period

4. Claims must be submitted to IMG within 180 days of the date the claim arises to receive payment.

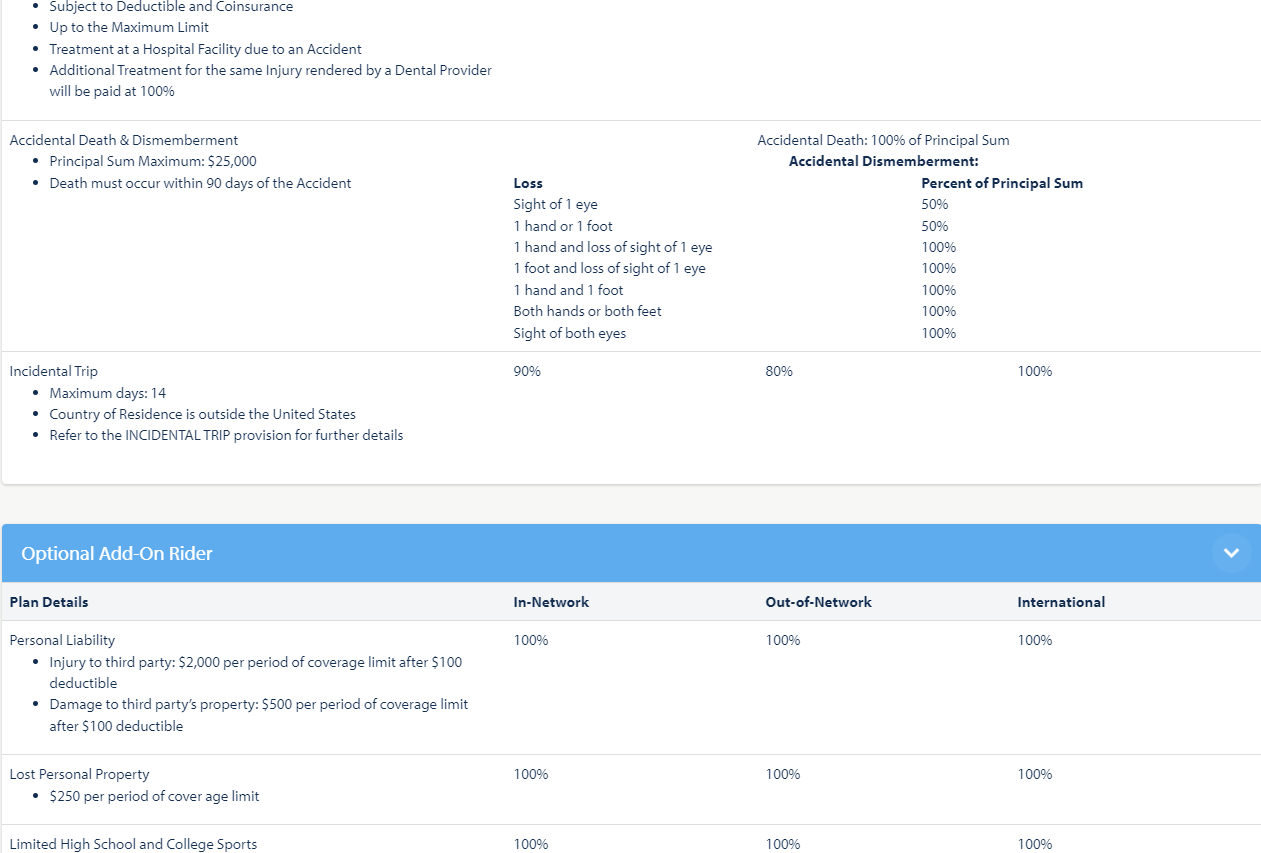

▶ Active participants, spouses of participants, or family members traveling with participants in study or exchange programs (i.e., student visas, exchange visas, visitor visas).

▶ Individuals temporarily residing abroad with J1/J2, M1/M2, F1/F2, or A1/A2 visas for international educational activities.

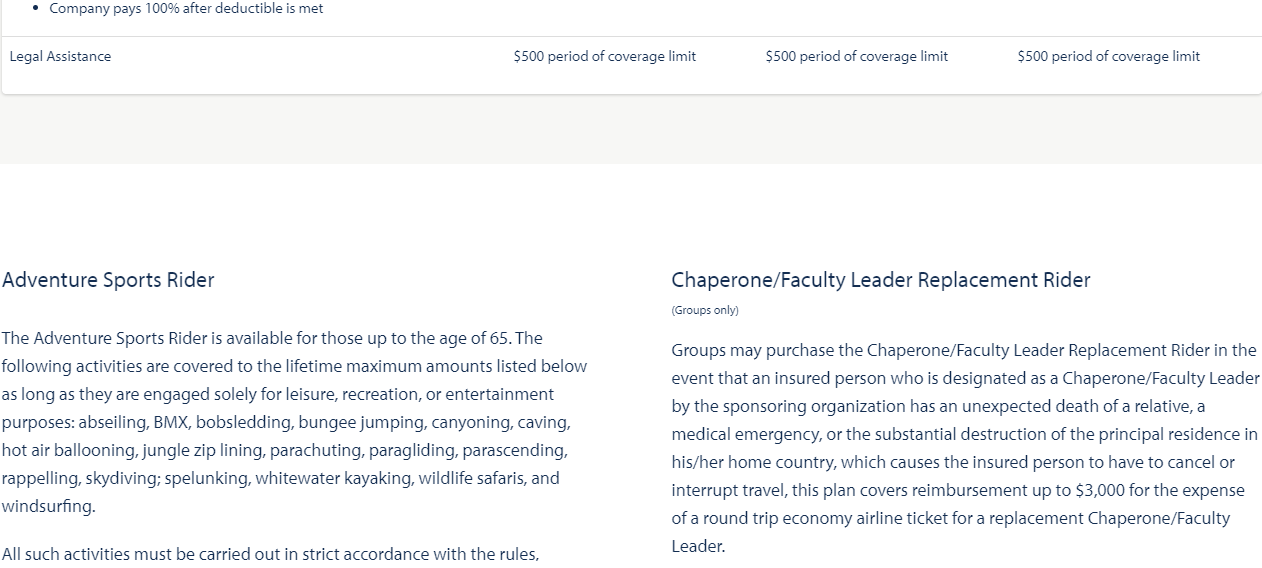

▶ Infants born within 31 days up to individuals aged 65.

▶ Individuals who are legally residing in the destination country/region and intend to reside there for at least 30 days during the effective date and renewal.

▶ No hospitalization, disability, or positive HIV status at the initial effective date.

Eligible insureds can request coverage under the plan be renewed monthly for up to 12 month periods, for a maximum of 48 continuous months, as long as the premium is paid when due and the insured continues to meet the eligibility requirements of the plan.

Patriot Exchange Program premium price list

Premium: Regularly paid insurance fee.

Co-Pay: Similar to the registration fee in China, it is paid for each hospital visit. The amount of co-pay varies depending on your insurance type and your medical condition.

Deductible: The amount you must pay out of pocket. For example, if your deductible is $1500, you must cover all medical expenses within this amount. Any costs beyond $1500 will be shared between the insurance company and the insured on a proportional basis. Therefore, the lower the deductible, the higher the premium.

Co-Insurance: After reaching the deductible amount, you need to pay a percentage of the costs. For instance, if you choose 30% co-insurance, and a medical expense is $100, the insured only pays $30, and the insurance company covers the remaining $70.

Out-of-Pocket Maximum/Limit: The maximum amount you need to pay out of pocket for the entire year. Once this limit is exceeded, the insurance company covers the remaining medical expenses in full. This is cumulative, meaning, for example, if the out-of-pocket max is $10,000 and the combined deductible and co-insurance for various medical bills in a year amount to $25,000, you only need to pay $10,000, and the remaining $15,000 will be covered by the insurance company.

In-Network & Out-of-Network: In-network hospitals PPO are those contracted with the insurance company, while out-of-network hospitals are not contracted. It's important to note that the cost-sharing ratio for in-network and out-of-network hospitals may differ. For example, in some insurance policies, the insurance company covers 80% of in-network hospital expenses but only covers 60% of out-of-network hospital expenses.

FWechat QRCODE